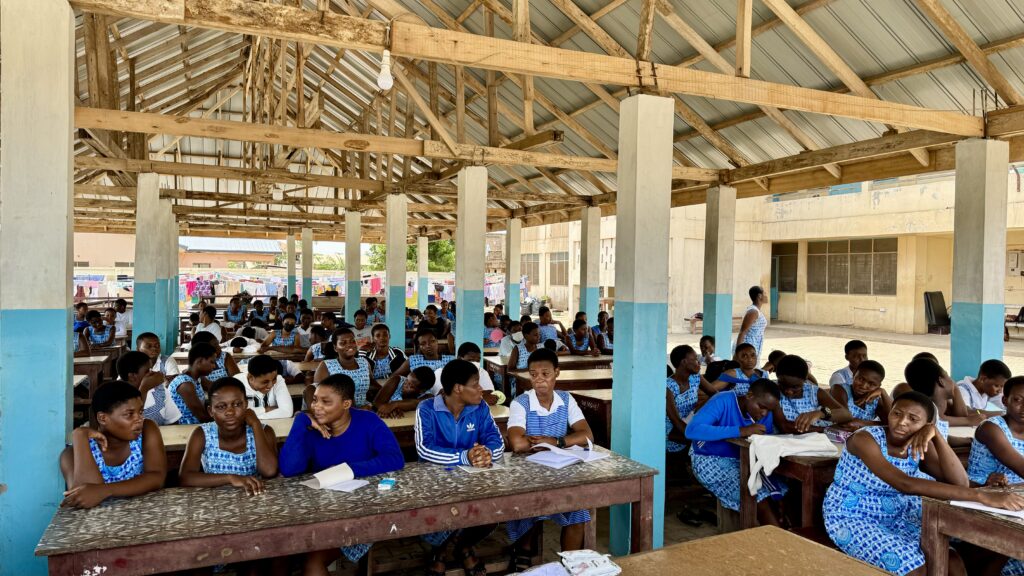

As we strive for economic growth and prosperity, it’s imperative to equip our youth with essential life skills. However, the lack of financial education in Ghanaian high schools remains a pressing concern. Without proper guidance, many students graduate without the fundamental knowledge needed to navigate the complexities of personal finance.

The Consequences of Financial Illiteracy:

Specific examples or case studies from Ghana vividly illustrate the consequences of a lack of financial literacy. For instance, stories of individuals falling victim to Ponzi schemes or predatory lending practices highlight the real-world impact of financial illiteracy on vulnerable communities.

The Economic and Social Impact

Statistics or data underscore the impact of financial illiteracy on the economy and social inequality. According to recent studies, countries with higher levels of financial literacy tend to have lower rates of poverty and higher levels of economic growth. In Ghana, where a significant portion of the population lacks basic financial knowledge, the consequences are evident in the form of widespread poverty and limited access to financial services.

Insights from Experts

Experts in the field of finance and education provide valuable insights into the situation. They emphasize the need for comprehensive financial education programs that start at a young age and are integrated into the school curriculum. By equipping students with the necessary knowledge and skills, Ghana can empower future generations to make informed financial decisions and break the cycle of poverty.

Efforts to Incorporate Financial Education

Highlighting existing efforts to incorporate financial education into Ghanaian high schools offers readers hope and direction. While progress has been slow, there are initiatives underway to introduce financial literacy courses and workshops in schools across the country. These efforts, supported by government agencies, nonprofit organizations, and private sector partners, represent a step in the right direction toward bridging the gap in financial education.

Conclusion

By investing in financial education for high school students, Ghana can empower the next generation to make sound financial decisions, break the cycle of poverty, and contribute to the long-term prosperity of the nation. It’s time to bridge the gap and ensure that every student has the knowledge and skills they need to build a brighter financial future.